Certification Status

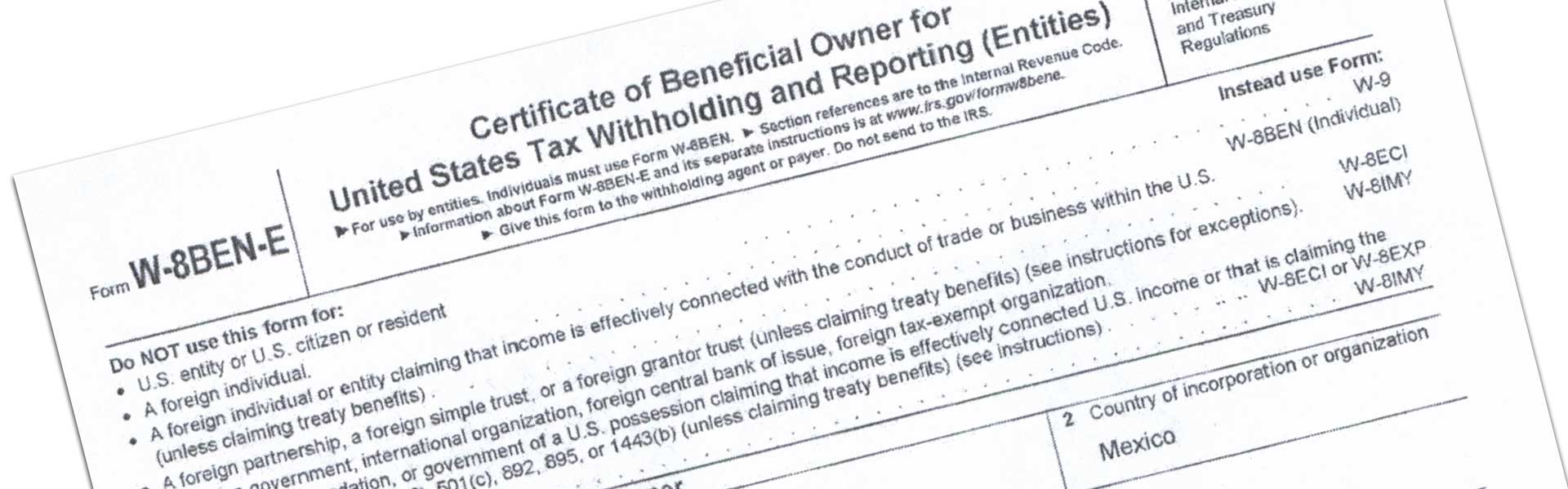

According to U.S. Internal Revenue Service regulations, foreign individuals and entities must provide certification of foreign status every three years. The certification requires completing Form W-8BEN (Certificate of Foreign Status of Beneficial Owner) for foreign individuals or Form W-8BEN-E for Entities and providing the bank a properly executed copy of that document. Accounts that are not properly certified are subject to U.S. withholding tax of 30% on the interest income received.

Forms W-8BEN and W-8BEN-E and instructions for completing the forms are available at the IRS or U.S. Post offices. You can also access the forms and instructions by clicking the links below: